A People's Victory: Thailand's Path Forward with Cannabis

Preserving freedom in the cannabis marketplace: the expansion of legalization in Asia Pacific and a revival of community enterprises to unleash the prosperity of a re-invigorated industry.

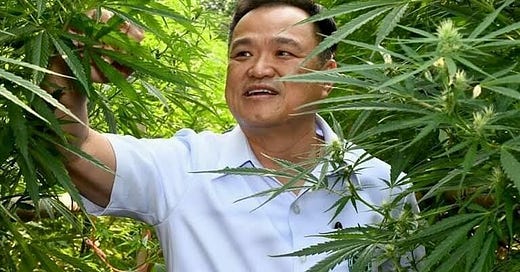

"This is a people’s victory, not ours," declared Anutin Charnvirakul, the deputy prime minister and leader of the Bhumjaithai Party, after Prime Minister Srettha Thavisin's decision to withdraw the plan to reclassify cannabis as a narcotic. This landmark decision came in response to demands from various stakeholders and reflects a significant shift in Thailand's approach to cannabis regulation.

The government will now consider several draft legislations to establish a comprehensive framework for the cannabis industry. Among the proposals are Bhumjaithai’s version, which was submitted to parliament last September, and another draft by former public health minister Cholnan Srikaew. This legislative effort aims to provide clear guidelines for the cannabis industry, which has been operating in a legal grey area since the decriminalization of marijuana in June 2022.

Thailand: A Beacon for Cannabis Regulation

Thailand’s decision to shelve the re-criminalization of cannabis and instead tighten regulations is a critical development for other middle-income nations. As a pioneer in the decriminalization of cannabis, Thailand serves as a model for countries seeking to balance access for producers and consumers with the need for regulation.

1. Setting a Precedent for Middle-Income Nations

Thailand's progressive stance on cannabis can inspire other middle-income nations interested in exploring the benefits of cannabis legalization. By keeping cannabis decriminalized and creating a legal framework for producers and consumers, Thailand has demonstrated that it is possible to regulate the industry effectively while promoting public health and safety.

It is a vote for a safe yet free market for cannabis - a bold “yes” to the question of whether decentralized markets are the simple pathway to a healthy industry, even when that industry comes with its own hazards.

For countries considering similar policies, Thailand offers valuable lessons. The Thai government's approach to engaging stakeholders, including growers, dispensary owners, and the medical community, highlights the importance of a collaborative process in developing the cannabis sector. This inclusive strategy can help other nations navigate the complexities of cannabis legalization and ensure the benefits are widely distributed.

With a medical cannabis regime that can expand with demand, innovators are free from the chilling effects of a pall of legal repercussions hanging over their decision-making and experimentation.

Two aspects of the nascent industry are illustrative of the impact of keeping cannabis decriminalized and decentralized: community enterprises and the birth of a medical cannabis import/export hub.

2. Innovating with Community Enterprise Initiatives

Thailand's approach to cannabis regulation has always included an emphasis on community enterprise initiatives. These initiatives aim to ensure that the economic benefits of the cannabis industry are widely distributed, particularly among local farmers and small-scale producers.

Community enterprises have had a rough start. First, in 2018, when medical cannabis was first launched, they were priced out of farmland; then, after decriminalization in 2022, they were flattened by the hype generated by the profusion of thousands of new dispensaries across the country. Now that sensible regulation is on the agenda, they will have a third chance to gain traction in the marketplace.

Lessons Learned: Toward A Better Community Enterprise Model

1. Cooperative Structure:

Many cannabis community enterprises in Thailand operate as cooperatives, where local farmers join forces to cultivate, process, and market cannabis products. These cooperatives pool resources, share knowledge and work collectively to meet regulatory requirements and quality standards.

Members of the cooperative share profits, ensuring that the economic benefits are distributed equitably.

2. Support and Training:

The idea is that the Thai government and various non-governmental organizations (NGOs) provide training and support to farmers involved in cannabis cultivation. This has not gone well, as neither the government nor the NGOs operate from a solid knowledge base themselves.

The problem is compounded by a lack of clear incentives for the training to be successful.

Training programs cover best practices in cultivation, pest management, organic farming techniques, and compliance with legal standards must be led by companies that are competitive in the marketplace; now that decriminalization is becoming institutionalized, there’s good reason for optimism this time around.

Farmers are also educated on the medicinal properties of cannabis and the potential markets for their products.

3. Access to Markets:

Community enterprises often have access to government-supported markets and distribution channels, helping them to sell their products more effectively.

Some cooperatives have established direct relationships with medical facilities, wellness centers, and international buyers, providing a steady demand for their cannabis products.

There is a new success story in Nonteburri that is a vertical supplier - from seed to clinic to patient to consumer - with a full range of Thai Traditional medical practices available on the same property as the cannabis farm.

Economic Impact

1. Income Generation:

Cannabis cultivation has become a lucrative cash crop for some Thai farmers, providing a significant boost to their income; Farmers in successful community enterprises typically earn higher profits than traditional agricultural activities, such as rice or rubber farming. The challenge is how to decrease the number of failures.

2. Job Creation:

The cannabis industry has created numerous jobs in cultivation, processing, quality control, and distribution. These jobs are not limited to farming but are integrated into a particular community enterprise as ancillary services, such as research, education, and tourism

3. Community Development:

Profits from cannabis enterprises are often reinvested in the local community, funding infrastructure projects, educational programs, and healthcare services. This reinvestment helps to improve the overall quality of life in rural areas and promotes sustainable development.

Innovations: Community Enterprises 2.0

1. Product Diversification:

Community enterprises are exploring a variety of cannabis products beyond traditional flowers, including oils, tinctures, edibles, and topical treatments.

This diversification helps to tap into different market segments and increase revenue streams.

2. Collaborations with Research Institutions:

Some cooperatives have partnered with universities and research institutions to study the medicinal properties of cannabis and develop new therapeutic applications. These collaborations enhance the scientific understanding of cannabis and lead to the creation of innovative products.

3. Tourism and Education:

The rise of cannabis tourism has opened new opportunities for community enterprises. Visitors can tour cannabis farms, learn about cultivation practices, and purchase products directly from growers.

Educational workshops and seminars on cannabis cultivation and its benefits are also becoming popular, attracting both locals and tourists.

Thailand’s emphasis on cannabis community enterprises is a testament to its commitment to creating an inclusive and sustainable cannabis industry. By empowering local farmers and ensuring equitable distribution of economic benefits, these initiatives aim to transform rural communities and set a precedent for other nations.

As Thailand continues to innovate and expand its cannabis sector, the success of these community enterprises will play a crucial role in the country’s economic and social development.

Thailand as a Cannabis Hub: Economic Insights with Comparisons to South Africa

Thailand's strategic positioning as a cannabis hub is poised to have significant economic implications. Here are detailed economic facts and projections about Thailand's emerging role in the global cannabis market, with comparisons to South Africa, another key player in the cannabis industry.

Market Size and Growth Potential

1. Domestic Market Value:

The Thai cannabis market was valued at approximately $660 million in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 15-20% over the next five years. South Africa’s cannabis market, while smaller, was valued at around $300 million in 2023, with a similar growth trajectory expected as regulations evolve and market acceptance increases.

2. International Market Value

The global cannabis market is expected to reach $73.6 billion by 2027. Thailand and South Africa both aim to capture significant shares of this market through exports and international partnerships.

Thailand’s proximity to major Asian markets, including China, India, and Japan, provides a strategic advantage for export opportunities. South Africa’s advantageous location offers access to European and African markets, positioning it as a gateway for cannabis trade within these regions.

Export Opportunities

1. Medicinal Cannabis:

Thailand’s medicinal cannabis products are in high demand due to the country's rigorous quality standards and tropical climate, ideal for cannabis cultivation.

South Africa, known for its favorable growing conditions and experience in traditional agricultural exports, is developing a strong presence in the medicinal cannabis sector. It aims to export to Europe, North America, and other African countries.

Both countries are poised to become major exporters of high-quality medicinal cannabis products.

2. Cannabis Derivatives:

Thailand is exploring the export of cannabis derivatives, including oils, tinctures, and isolates. These products have high-profit margins and diverse applications in pharmaceuticals, cosmetics, and wellness industries.

Similarly, South Africa is focusing on producing and exporting cannabis extracts and derivatives, leveraging its existing agricultural processing infrastructure.

Economic Contributions

1. Job Creation:

Thailand’s cannabis industry is expected to create over 100,000 jobs within the next five years, spanning cultivation, processing, research, distribution, and retail sectors.

South Africa’s cannabis sector is projected to create around 25,000 to 50,000 jobs in the same period, with significant potential in rural areas where job opportunities are scarce.

2. Investment and Infrastructure:

According to globalcannabistimes.com, in 2023, investments in Thailand’s cannabis sector exceeded $200 million, with funds directed toward cultivation facilities, research centers, processing plants, and distribution networks.

South Africa has also attracted substantial investments, particularly from Canadian and European companies interested in establishing a foothold in the African cannabis market.

Both countries are seeing significant investment in infrastructure to support the burgeoning cannabis industry.

3. Tourism and Hospitality:

Cannabis tourism is an emerging sector in Thailand, with tourists visiting to experience its cannabis culture, tour cultivation sites, and participate in wellness retreats.

South Africa, already a popular tourist destination, is incorporating cannabis tourism into its offerings, including cannabis farm tours, educational workshops, and wellness experiences.

The influx of cannabis tourists is expected to boost the hospitality industry, including hotels, restaurants, and local businesses, contributing significantly to the economy.

Research and Development

1. Centers of Excellence:

Thailand is establishing itself as a center for cannabis research and development (R&D), with universities and research institutions dedicated to studying the plant’s medicinal properties and developing new products.

South Africa is leveraging its robust research infrastructure and expertise in agriculture and pharmaceuticals to advance cannabis R&D.

Both countries are investing in research to create high-quality, safe, and effective cannabis products, enhancing their competitive edge in the global market.

2. Clinical Trials and Pharmaceutical Development:

Thailand is conducting clinical trials to explore the efficacy of cannabis in treating various medical conditions, such as chronic pain, epilepsy, and cancer-related symptoms. Botanicals often get fast-tracked through the Department of Thai Traditional Medicine, shaving years off the conventional process of new drug approval.

The shorter process means walking a new drug through the approval process can be exponentially less costly, a fact that has convinced famed cannabis drug developer Dr. Ethan Russo to leverage Thailand’s speedy approval process for several cannabis-based botanicals.

South Africa is also engaged in clinical research, aiming to develop cannabis-based pharmaceuticals for both domestic use and export.

Successful trials and subsequent approvals will position both countries as leading suppliers of cannabis-based pharmaceuticals globally.

Policy and Regulation

1. Regulatory Framework:

Thailand’s regulatory framework is now set to become institutionalized, which means it will be harder to undermine as the years pass; consequently, it can focus on ensuring the quality and safety of cannabis products, fostering consumer trust and encouraging market growth.

South Africa is developing a comprehensive regulatory framework to support the legal cannabis industry, with a focus on quality control and market transparency.

Clear regulations provide a stable environment for investors and entrepreneurs, promoting sustainable industry development in both countries.

2. International Collaboration:

Thailand is engaging in international collaborations to harmonize standards and practices in the cannabis industry, facilitating smoother trade and investment flows.

South Africa is also collaborating with international partners to adopt best practices and enhance its competitive edge. In fact, the two countries could begin talks on a bi-lateral cannabis trade agreement as early as January 2025.

Partnerships with countries that have advanced cannabis industries, such as Israel and Canada, are helping both Thailand and South Africa to advance their cannabis sectors.

Summing Up

Thailand and South Africa are positioning themselves as key players in the global cannabis market, leveraging their unique strengths and strategic locations. The economic benefits from job creation, foreign investment, and increased trade are substantial for both countries. By focusing on high-quality production, research, and international collaboration, Thailand and South Africa are set to lead in the global cannabis industry, providing valuable models for other nations to follow.